Property taxes fund a meaningful part of Hartford’s budget. The City has a split tax system in which residential real estate is taxed at a lower rate than other property types.

Specifically, single-family homes, two-family homes, three-family homes, condominiums, and a couple other smaller property classes are assessed at about 30% of Market Value (as of Grand List 2013). The State standard assessment ratio used by all other Connecticut municipalities, and used for other property classes within the City, is 70% of Market Value.

For the current fiscal year, which utilizes Grand List 2013, a residential property with a market value of $150,000 will owe about $3,335 in annual taxes. The effective tax rate is about 2.2% of market value.

The City Assessor’s office provided data for all the real estate that qualifies for the reduced residential assessment ratio for Grand List 2013. Using this list, the current assessment ratio of 29.93%, and the current mill rate of 74.29, the annual taxes were calculated.

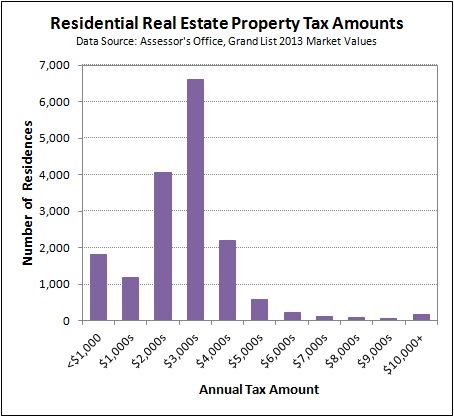

The chart below shows how the annual residential properties taxes were distributed. For example, there were 6,608 properties that owed between $3,000 and $3,999, which is shown as the “$3,000s” in the chart.

There were 17,126 residential properties in the dataset. The average annual bill was about $3,240 and the median annual bill was about $3,182.