Hartford’s financial condition has gotten to the point where it cannot be fixed in a single budget cycle. Breaking the process into phases will give the City a better chance at success.

Restructuring will require collaboration between all stakeholders; the Administration, the City Treasurer, the City Council, City employees, the State, the business community, the non-profit community, and the residents. Presumably there are others that have been left off this list; they should be included too.

It is not a process than can, or should, be handled quietly in back rooms and then presented in final form.

Phase 1: Develop Goals and Strategy

Once the community commits to making difficult changes, the first step will be to develop goals and a strategy. All stakeholders need to be involved in the conversation. There must be an extensive public discussion.

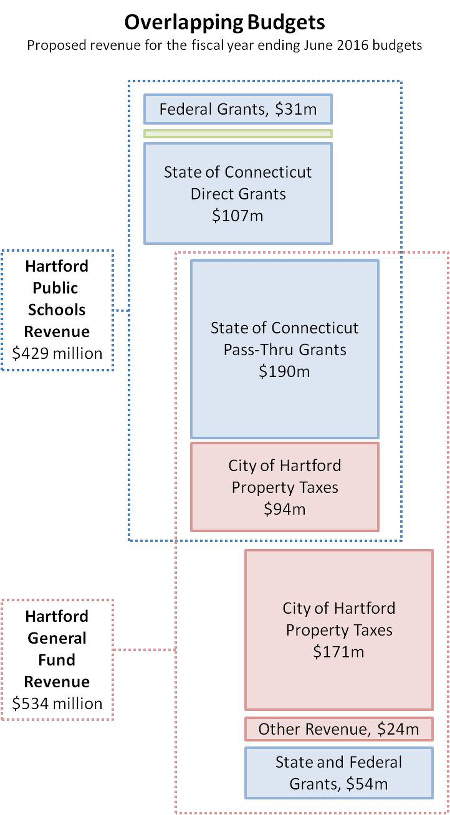

Practical concerns seem most pressing. Can Hartford find a balance between revenue, operating expenses, and long-term liabilities?

Philosophical concerns are also important, given the City’s limited resources. How much should the municipal government try to accomplish? How should municipal objectives be prioritized?

Phase 2: Implement Expense Reductions

Reducing expenses first is more conservative than trying to do everything at once. Even the most well thought out plans involve estimates. The City needs to know how effective the expense reduction initiatives will actually be before adjusting the revenues.

It could take years to fully implement the expense reduction ideas, as agreements will likely need to be negotiated with the employee unions.

Reducing expenses first will also allow the City to operate at a surplus for one or more years. The extra funds will not be needed for operations, so they can be used to pay down the bonded debt, improve the pension plan’s funding level, or fund an account for Other Post Retirement Benefits.

Phase 3: Adjust the Revenue

Once City operations have been reorganized, the revenue can safely be adjusted. In practical terms this means dealing with the split tax rate so that the mill rate can come down.

Conclusions

Hartford’s current strategy of hoping that the financial stress resolves itself has failed. A new strategy is required, and it will take years to identify and implement the necessary changes.

The first step is starting the conversation.

Stakeholders need to identify their goals and priorities for the municipal government. Ultimately, Hartford needs as much input as possible, from everyone who has a stake in the community.