Motor vehicles are taxed at the municipal level in Connecticut. The City of Hartford’s mill rate is the highest in the state, at 74.29 mills in the current fiscal year. Hartford residents, therefore, pay the highest car tax rate in Connecticut.

The vehicle tax calculation begin with a State-provided schedule that gives a car’s market value based on its year, make, and model. It is an automated step that does not allow municipalities to make adjustments for a vehicle’s condition.

Motor vehicles are assessed at 70% of the market value, and the mill rate is applied to the assessment.

For the current fiscal year, which is utilizing Grand List 2013, a vehicle with a market value of $10,000 will owe $520 in taxes for the year. The effective tax rate is about 5.2% of market value.

Vehicles are constantly being added to, and removed from, the tax roles. The City Assessor’s office provided a snapshot of the vehicles that were registered in the City on October 1, 2013, which is the valuation date for Grand List 2013.

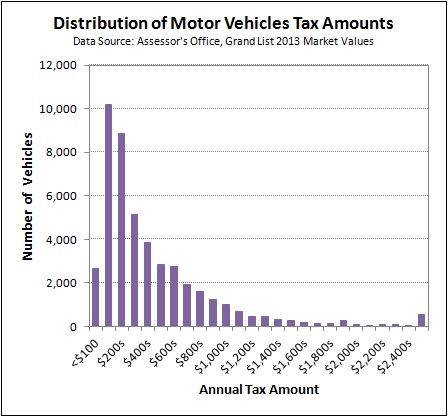

The chart below shows the annual tax amount along the horizontal axis in bands of $100. The vertical axis shows the number of vehicles that owe annual taxes in each of the bands. For example, there were 8,873 vehicles that owe taxes in an amount between $200 and $299, which is shown as the “$200s” in the chart.

There were 46,107 vehicles in the data set. The average annual bill was about $498 and the median annual bill was about $321.