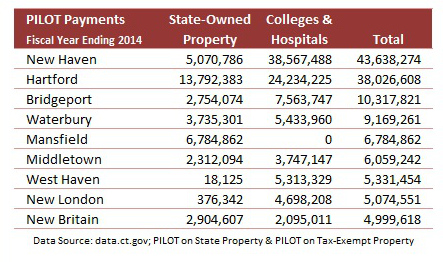

Data from the CT.gov Open Data Website shows that Hartford was the second largest recipient of Payment in Lieu of Taxes (PILOT) funding in the State for the fiscal year ending in June of 2014.

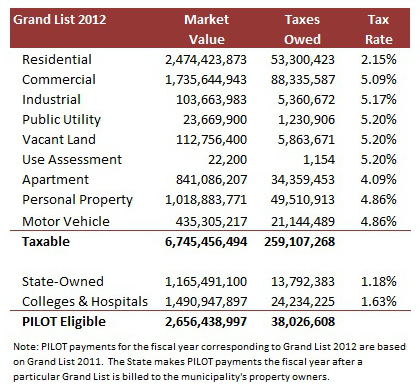

Within the City of Hartford, the market value of tax exempt property eligible for PILOT funding totaled about $2.6 billion during that fiscal year. As a point of comparison, this was slightly higher than the market value of all the Residential property.

Property tax rates in Hartford vary by property type due to the split assessment ratio. The effective “tax rate” of the PILOT program can be calculated and compared to the other property classes.

The chart below shows that the State paid a lower tax rate than even the heavily protected Residential property owners. Data for the taxable property classes came from a handout given to the 2013-2014 Tax Task Force.