The State of Connecticut has created a program to help address the loss of property tax revenue that municipalities experience due to certain types of tax-exempt property. The program is called Payment in Lieu of Taxes (PILOT).

PILOT reimburses cities and towns a percentage of a qualifying property’s potential tax liability. There are two portions of the program. One portion covers State Owned property. It specifies that prison facilities are reimbursed at 100% of the tax rate, and all other qualified state owned property are reimbursed at 45%. The other portion covers Private Colleges and Hospitals, which are reimbursed at 77% of the tax rate.

Sections 12-19a and 12-20a of the Connecticut General Statutes, which define the PILOT program, appear to have been created in the 1970s. There have been numerous changes to each section over the years, including what is covered and the formula used to calculate the grants.

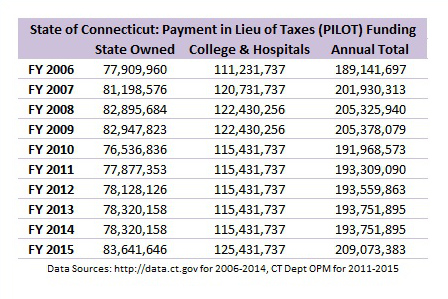

Information from the Open Connecticut Data website shows that the overall PILOT program has been about a $200 million line item for the State over the past 10 years.

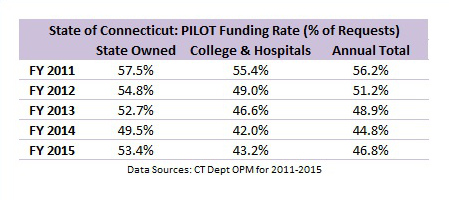

However, the PILOT program is not fully funded. The municipalities that request reimbursement only receive about half of the amount they request according to the Department of Operations, Policy and Management.

The reimbursement percentage that each municipality receives varies based on their mix of qualifying property types.

To illustrate the calculation, consider a hypothetical town that has one qualifying State Owned building. The town’s Assessor would value the property and calculate a tax bill for the parcel. Since it’s a general State Owned building, it would qualify for the PILOT program at a 45% reimbursement rate. The State Legislature has funded the PILOT program for State Owned buildings at 53.4% in the current fiscal year. The town would receive a grant for 45% * 53.4% = 24.0% of the tax bill for that property.

The program pages on the State website notes that 169 municipalities and 5 boroughs receive grants for State Owned property, while 59 towns and 14 taxing districts receive grants for Colleges and Hospitals.